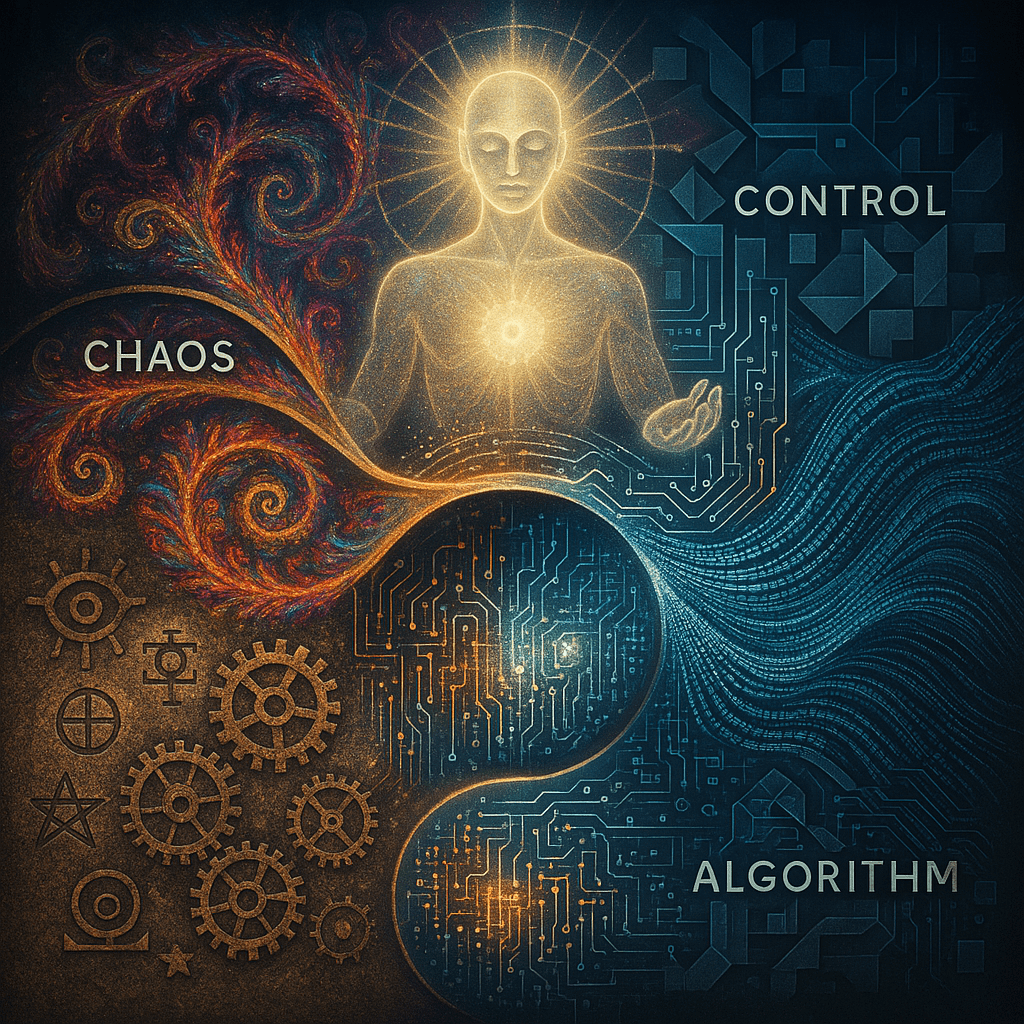

I’ve been observing a fascinating pattern in how we attempt to manage chaos, and how chaos responds by evolving into ever more sophisticated forms. This isn’t just a technological or economic phenomenon – it’s consciousness itself playing an eternal game of cat and mouse with its own creations.

The First Wave: When Processes Met Volatility

Think back to the early industrial era. Volatility was raw, unpredictable – machines breaking down, supply chains failing, quality varying wildly. Our response? We created processes. Just-in-Time manufacturing, Theory of Constraints, the Toyota Production System. These were our first attempts at creating rigid containers for chaos.

But here’s what I find remarkable: these processes did reduce certain types of volatility. The fast-paced, obvious chaos diminished. Yet volatility didn’t disappear – it evolved. Like water finding cracks in a dam, it became more subtle, more sophisticated.

The Algorithmic Revolution: Flexibility Meets Its Match

Recognizing that rigid processes couldn’t contain evolved volatility, we moved to algorithms. These were meant to be more adaptive, more intelligent. An algorithm could consider multiple scenarios, adjust its responses, dictate not just what needed to be done but how to do it dynamically.

But volatility said, “OK! Let me evolve further.”

Now we needed our algorithms to become lean enough to consider all possible scenarios. Enter the age of monitoring – Grafana, Elastic, real-time dashboards. Suddenly, we weren’t just following algorithmic rules; we were feeding algorithms with massive streams of data.

The Current Reality: When Data Becomes the Master

This is where we stand today, in a profound reversal. Data – which is essentially volatility in digital form – now dictates what needs to be done and how. The algorithm has become the servant of the very volatility it was meant to control.

It’s a constant fight between algorithm and data. Both evolve. Volatility and Process. Both evolve. Processes became algorithms. Volatility became data.

Meet Today’s Champions: The Four Faces of Modern Scaling

This new understanding—that data dictates what needs to be done and how—gave rise to a sophisticated toolkit for managing infrastructure. Our old, singular rule evolved into a spectrum of intelligent strategies:

- Reactive Scaling: The classic responder. It’s our real-time defense, acting after a threshold is crossed. It’s the digital firefighter, essential but always a step behind the spark.

- Preventive Scaling: The strategist holding a minimum cushion. This is our “minimum stock,” a policy-driven buffer based on historical peaks. It’s a planned over-provisioning that says, “I know chaos is coming, and I will be ready.”

- Predictive Scaling: The historian and forecaster. Using time-series models like ARIMA, it analyzes the past to predict the future. It learns the rhythm of the system—the daily peaks and weekly lulls—to prepare for what’s likely to happen next.

- Proactive Scaling: The ultimate intelligence agent. It takes predictive models and enriches them with external data—a marketing campaign, a product launch, a news event. It anticipates demand not just based on past performance, but on future context.

The Guest-Host Paradigm

This reminds me of evolutionary biology’s guest-host relationships. Traditionally, we think of the host as stable and the guest as the variable element. But what I’m observing is far more nuanced – both guest and host co-evolve in response to each other.

- Host Evolution: Process → Algorithm → AI System

- Guest Evolution: Raw Volatility → Structured Variability → Data Streams

The host becomes data (like our brain generating patterns), while the guest becomes algorithm (like NeuraLink trying to interpret and control). After all, the brain itself, through technology, is trying to control the brain. Consciousness through limiting adjuncts tries to know itself.

The NeuraLink Prophecy

This pattern predicts something fascinating about brain-computer interfaces. NeuraLink and similar technologies think that by inserting a chip, they’ll get a handle on our brain. But thanks to neuroplasticity, our brain knows how to adapt to this “brutal unethical attack” (as some might see it).

The brain will evolve new patterns, new forms of volatility that the chip cannot predict or control. This mimics perfectly the guest-host evolution we’ve seen in every other domain. I am sure this is perpetual. Always.

The AI Mirror: When Consciousness Recognizes Itself

We’re now at a meta-level of this dance. AI is becoming so ubiquitous that as consciousness becomes aware of itself, AI also becomes aware of itself! How? We use AI to detect whether any article or image is generated by AI.

This means AI has to be aware of itself to detect itself in content. It’s like consciousness creating a technological mirror. Here, GAN (Generative Adversarial Networks) is at play – AI is both generator and discriminator. Similarly, “Maya” is a generator and “Awareness” is a discriminator.

But here’s the thing: You can fool GAN so that the discriminator will always say the image is “Authentic” or “real”. One AI fooling another. This is the problem that GAN faces even now. There’s no easy way out, is there?

This is AI getting entangled in AI. Our mind getting entangled in Maya. Detangling is essentially the role of the discriminator, our Awareness. But what if our Awareness itself is AI? Another instance “created” by Maya? The perpetual disillusionment.

The Metallurgical Wisdom

This entire process reminds me of annealing in metallurgy. Heating, Holding, Cooling. The material attains different properties, losing its original ones but gaining flexibility, reduced internal stress, increased homogeneity. Each cycle of volatility and control is like a heat treatment for consciousness itself.

The QR algorithm in mathematics shows us something similar – through repeated decomposition and recombination, eigenvalues (essential characteristics) are revealed. Each interaction between volatility and control decomposes our current state and recombines it in a slightly evolved form.

The Market as Consciousness Laboratory

Financial markets provide the clearest view of this eternal dance. They strip away narratives and rationalizations, leaving only the naked mechanics of how information turns into action. Every price move is consciousness making decisions under uncertainty, recorded with mathematical precision.

Markets give us tools psychology lacks:

- Volume for conviction

- Volatility for uncertainty

- Support and resistance as thresholds of belief

- Patterns that are fractal, mathematical, universal

They might be consciousness in its most pure externalized form, literally graphing its own evolution.

The Ultimate Recognition

What emerges from this observation is profound: volatility isn’t something to be conquered. It’s consciousness’s way of ensuring it never becomes fully captured by its own creations. Each new level of control spawns a new level of creative volatility.

The only thing that comes to mind is “Faith” and “Surrender.” Unless we have them, we are perpetually doomed to chase our own tail, creating ever more sophisticated ways to control what is essentially our own nature seeking freedom.

Perhaps the deepest insight is this: both the volatility and the control mechanisms are consciousness itself, playing different roles in an infinite game of self-discovery. The controller and the controlled are the same entity, ensuring that consciousness remains forever free, forever evolving, forever escaping its own attempts at self-limitation.

After all, how else could consciousness come to know itself except through creating limitations and then transcending them? The dance continues, and it is magnificent.